If you are someone who is thinking about acquiring a loan to buy a house in Burbank, you should definitely know about this. Having a lot of hard cash as the primary mode of payment for your loan is not really enough. What lenders really want to know is whether you are someone who will pay them back. They want to look at your debt-to-income ratio. What’s that? Read on.

What is a debt-to-income ratio (DTI)?

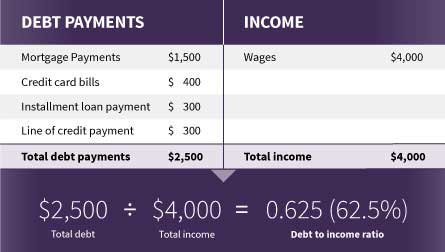

The DTI ratio is a financial method of comparing your total income with the amount of debt you have to repay. To calculate it, you have to divide your total monthly debt by your overall income per month. Then, you have to convert the resulting number into a percentage. If you’re still reeling from that formula then here’s a breakdown visually from a bank:

Typically lenders, including mortgage lenders, look for loan applications with as low a ratio as possible.

Why is this ratio necessary?

If you have referred to a property management company, then they would have told you about this. The whole point of the ratio is to let people know how you balance your debt and income. A low DTI means that you use a small amount of your total revenue to repay debts. This implies that you are a person who can afford to take a loan and successfully pay it back. No surprise there. Conversely, a higher ratio suggests that you will probably face difficulty in the repayment process. Hmm, time to recheck that DTI.

Generally, a preferable DTI is considered to be about 36% or lower. The maximum number will depend upon your lender. However, lending institutions typically do not loan money to people with a DTI higher than 43%. Definitely, aim lower than that.

The ratio also helps you to evaluate your financial situation. You know that a high ratio means either too little income or too much debt. Through it, you can identify which one you need to work on. It provides you with valuable insight, making you consider repaying the previous loans before opting for a new one. This way, you would also know whether it is the right time for you to buy a house or not.

How does a bad debt affect your credit score and DTI?

A ‘bad debt’ is a formal term used to signify loans that are irrecoverable, and will most definitely affect your profile negatively. The way it works is that a credit reporting agency has your profile data. They have the full history of your credit information and knows about all the debts that are unpaid. A bad debt signifies that you have reached a point where you are extremely unstable, financially speaking. Since your credit score is a numerical value signifying your creditworthiness and how good you are at repaying debts, the agency pushes the score down because of the bad debt so that it is evident to people where you stand. This negatively affects your debt-to-income ratio and your overall ability to get any loans.

There is no proper way to calculate how much the debt will lower your credit score. Usually, the higher the debt, the more negative the impact. A $50,000 debt will be more detrimental to your profile than a $1000 debt.

Precautionary Measures

If you’re planning to buy a house in the near future then it’s time to start evaluating your debt to income ratio. Now that you know how to calculate it, regularly work towards your goal of getting a DTI less than 30%. Once there go shopping for lenders, check their maximum limits and select that fits your lending needs.